Tap into benefits with Teroxx Pay

*Payment services provided by the third party company UAB Pervesk, which holds the electronic money institution (EMI) license No. 17, dated 06-11-2017, issued by Bank of Lithuania.

Now available

Pay Cards

The Teroxx Pay Card is a Visa debit card with a difference. As a Pay Card customer, you’ll have the option to enjoy premium Visa services (up to and including Visa Platinum) for private or business use depending on your chosen tier. Most excitingly, thanks to the card’s integration with the Teroxx App, you’ll have the opportunity to bridge your digital assets with real-world, everyday transactions, making your portfolio - and your payments - work better for you.

Interested? Sign up today to be among the first, and we’ll get in touch personally to walk you through activation.

*The pay card services are provided by Wallester AS

.jpg)

*The pay card services are provided by Wallester AS

Fees linked to card services

-

Card Usage (monthly fee)FreeCard Delivery Fee (Physical Card)FreeCard Express Delivery Fee (Physical Card)EUR 50,00

-

Balance CheckFreeCash Withdrawel in EEA*EUR 5 + 1%Cash Withdrawal in Non-EEA*EUR 5 + 3%

*EEA: European Economic Area

-

Foreign Exchange (Financial transaction made in currency that is not the same as account currency)2,75%

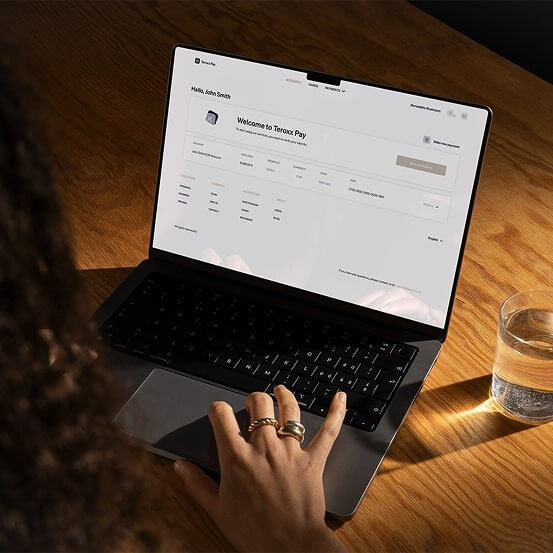

Online banking account and card

Payment Services

Payment Services by Teroxx Pay are designed with twenty-first century payments in mind. As a customer, you’ll receive an IBAN EUR account with Visa debit card for private or business use, the ability to make SEPA and SWIFT transfers in real time, and access to a slick, user-friendly dashboard to manage your transactions.

Getting started couldn’t be simpler. While our authorized compliance partner takes care of KYC/AML onboarding, you’ll have access to an in-house Relationship Manager for personal support setting up your account.

*Payment services provided by the third party company UAB Pervesk, which holds the electronic money institution (EMI) license No. 17, dated 06-11-2017, issued by Bank of Lithuania.

Fees linked to personal payment account

-

Maintaining the accountFree

-

Credit transfer (SEPA)*FreeCredit transfer (non SEPA)0.3 % (min. fee 25 EUR)Crediting of incoming payments in EURFreeCrediting of incoming foreign payments0.3 % (min. fee 25 EUR)Direct debitService is not providedAutomatic payment of e-invoicesService is not provided

* Transfers between UAB “Pervesk” payment accounts are always free.

-

Providing a debit cardFreeProviding a credit cardService is not providedCash withdrawal:Withdrawals (EEA)1.25 % (min. 1 EUR)Withdrawals (outside EEA)2.5 % (min. 2 EUR)Deposit of cashService is not provided

EEA - European Economic Area, UK - United Kingdom.