Spotlight:

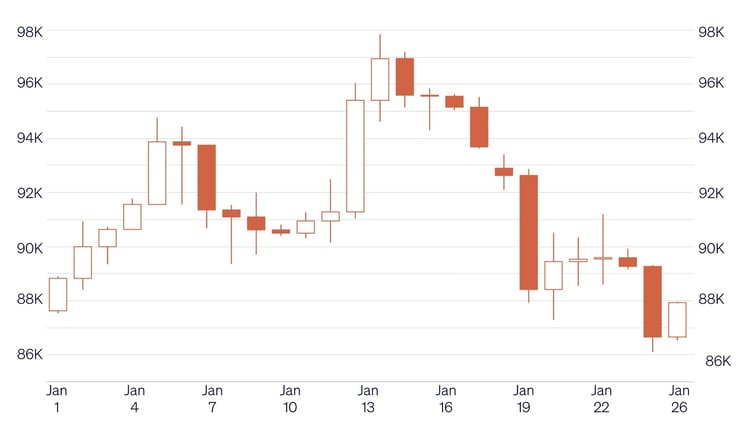

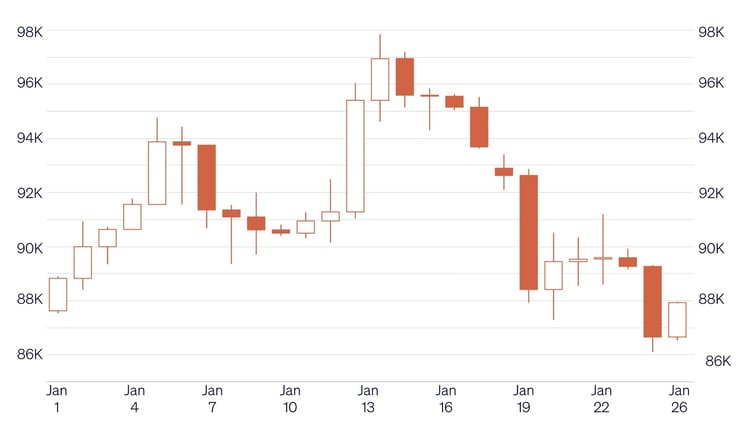

Bitcoin navigated a period of consolidation below the $88,000 level on Sunday and is trading around $87,800 amid thin weekend volumes. While the leading cryptocurrency has seen a slight pullback of roughly 1% over the last 24 hours the broader market followed suit with Ether falling toward $2,880 and Solana posting losses of between 3% and 5%. The dip triggered $224 million in liquidations which primarily cleared out over-leveraged positions in the futures market. This flushing of leverage often precedes more sustainable price discovery and suggests that the market is stabilizing after its recent volatility.

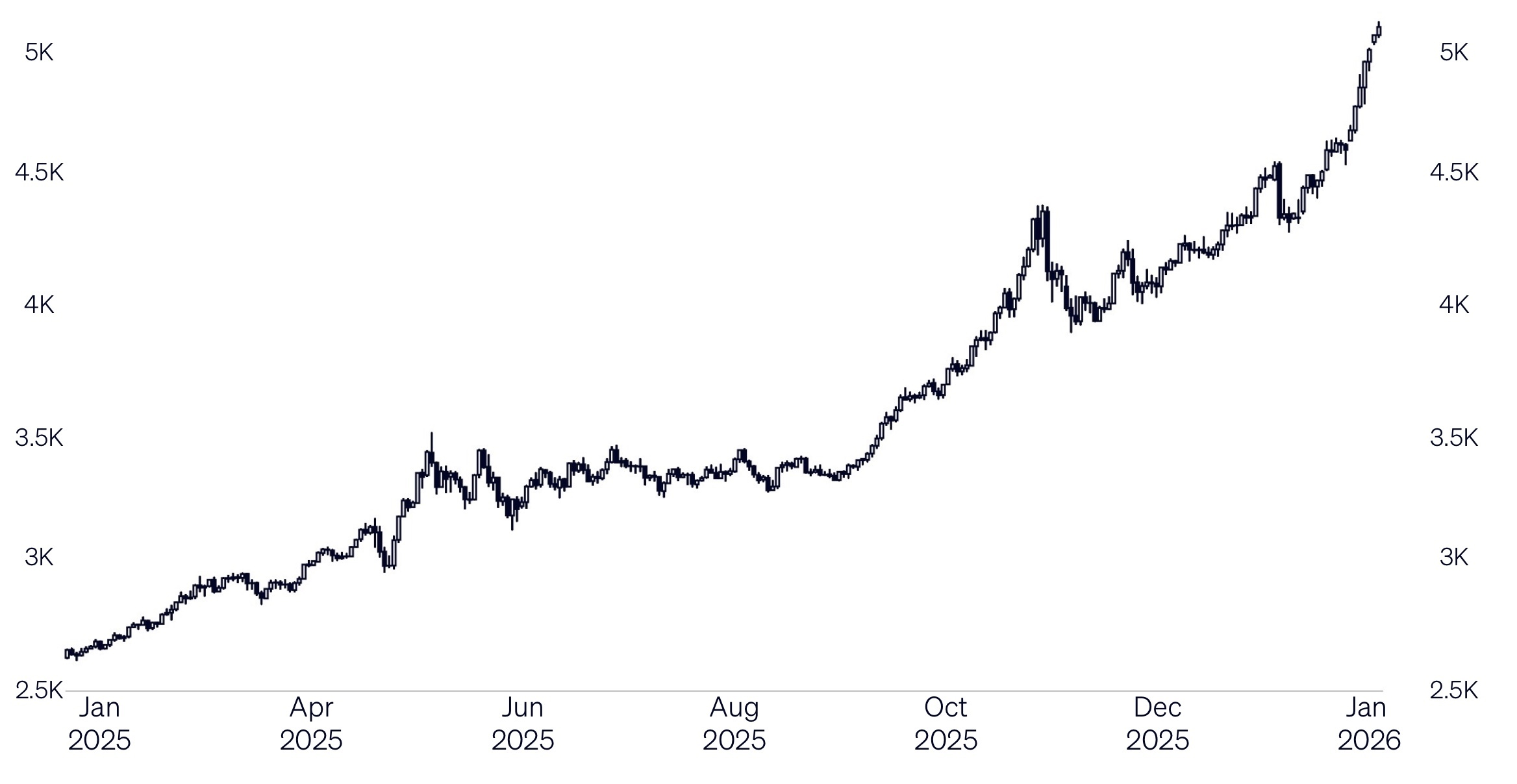

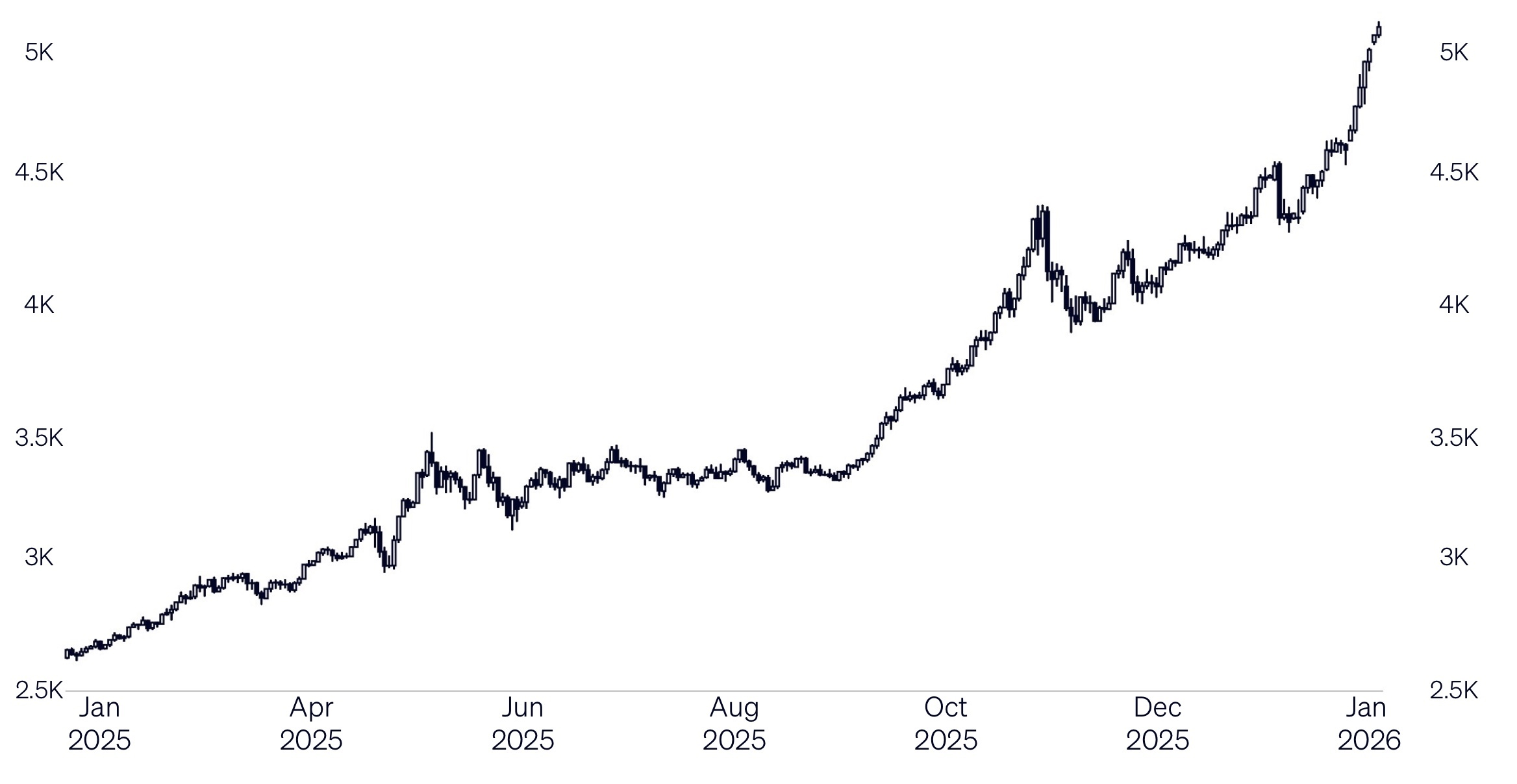

In contrast to the digital asset market Gold surged past the landmark $5,000 an ounce level on Monday extending a blistering rally as investors rushed into the safe-haven asset amid heightened geopolitical tensions like the Trump-Greenland episode. The metal jumped to a new all-time high driven by a combination of sustained demand from central banks and expectations of easier U.S. monetary policy later in 2026. This strong performance highlights the current preference for traditional defensive assets as investors seek protection against market volatility.

Despite this rotation into traditional havens Strategy Inc. continued its aggressive accumulation with a massive $2.1 billion Bitcoin purchase. However this acquisition did not spark immediate bullish momentum and has instead brought the company’s treasury strategy under closer scrutiny. Markets are increasingly questioning the long-term viability of this leveraged model amidst persistent price underperformance. Meanwhile capital flows have temporarily rotated toward technology stocks driven by the artificial intelligence hype which indicates that investor appetite for risk remains intact albeit currently focused on the equity sector.

On the regulatory front the industry continues to advocate for high standards. The delay of the long-awaited Digital Asset Clarity Act by U.S federal regulators has contributed to the current pause in price appreciation. However this delay follows opposition from major players like Coinbase who are pushing for a regulatory framework that is truly fit for purpose rather than accepting the bill in its current state. This insistence on getting the regulation right acts as a constructive step for the long-term maturity and clarity of the ecosystem.

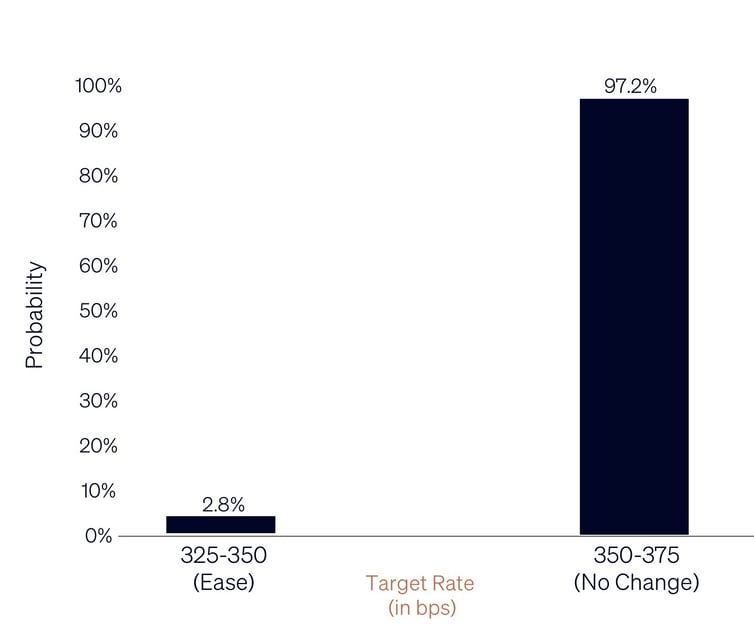

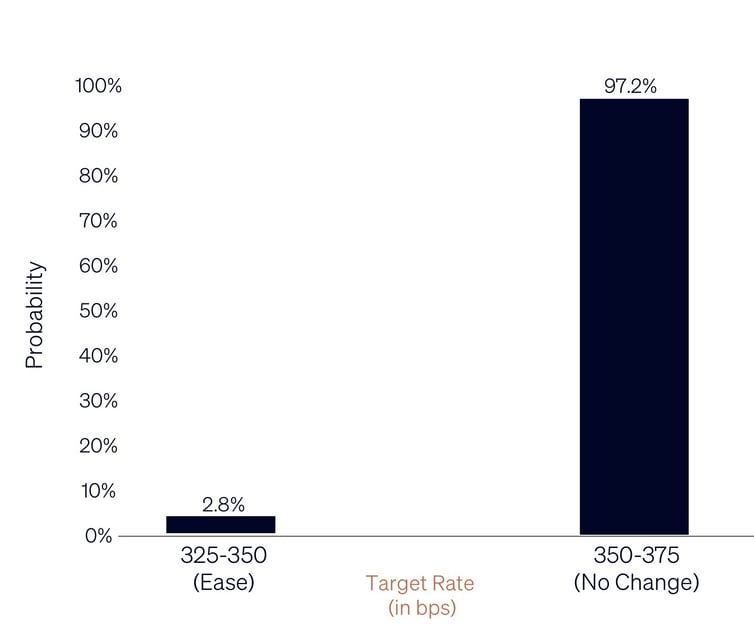

Looking ahead traders are entering the week with a keen eye on macro opportunities and corporate catalysts. In Asia markets are monitoring the Japanese yen following Prime Minister Sanae Takaichi’s warnings against abnormal market moves referring to the currency’s sudden and sharp rally which has raised intervention concerns. Concurrently U.S. political risks are rising with threats of a partial government shutdown over Department of Homeland Security funding disputes. Finally the market will be watching the Magnificent 7 earnings for AI insights and the Federal Reserve’s rate decision where Chairman Powell’s commentary could serve as a decisive factor in reigniting risk appetite.