Spotlight

This week, the digital asset market is focused on the crucial Federal Reserve meeting, with investors anticipating an interest rate cut based on recent data showing a weakening labor market and tame inflation. According to the CME FedWatch tool, Fed fund futures indicate a 94.2% chance the Fed will cut rates by 25 basis points (bps). Similarly, an analysis of CME's Fed funds futures shows traders have priced in an over 90% probability of such a cut, while also allowing for a slight possibility of a more significant 50 bps move. This outlook is critical for digital assets, as lower rates tend to benefit speculative assets by increasing market liquidity. However, uncertainty persists regarding the Fed's long-term view due to its repeated warnings about "sticky inflation" and Chair Jerome Powell's cautious stance. While other central banks in regions like the U.K., Japan, and Canada are also meeting, the Fed's decision on Wednesday is poised to be the most significant market catalyst.

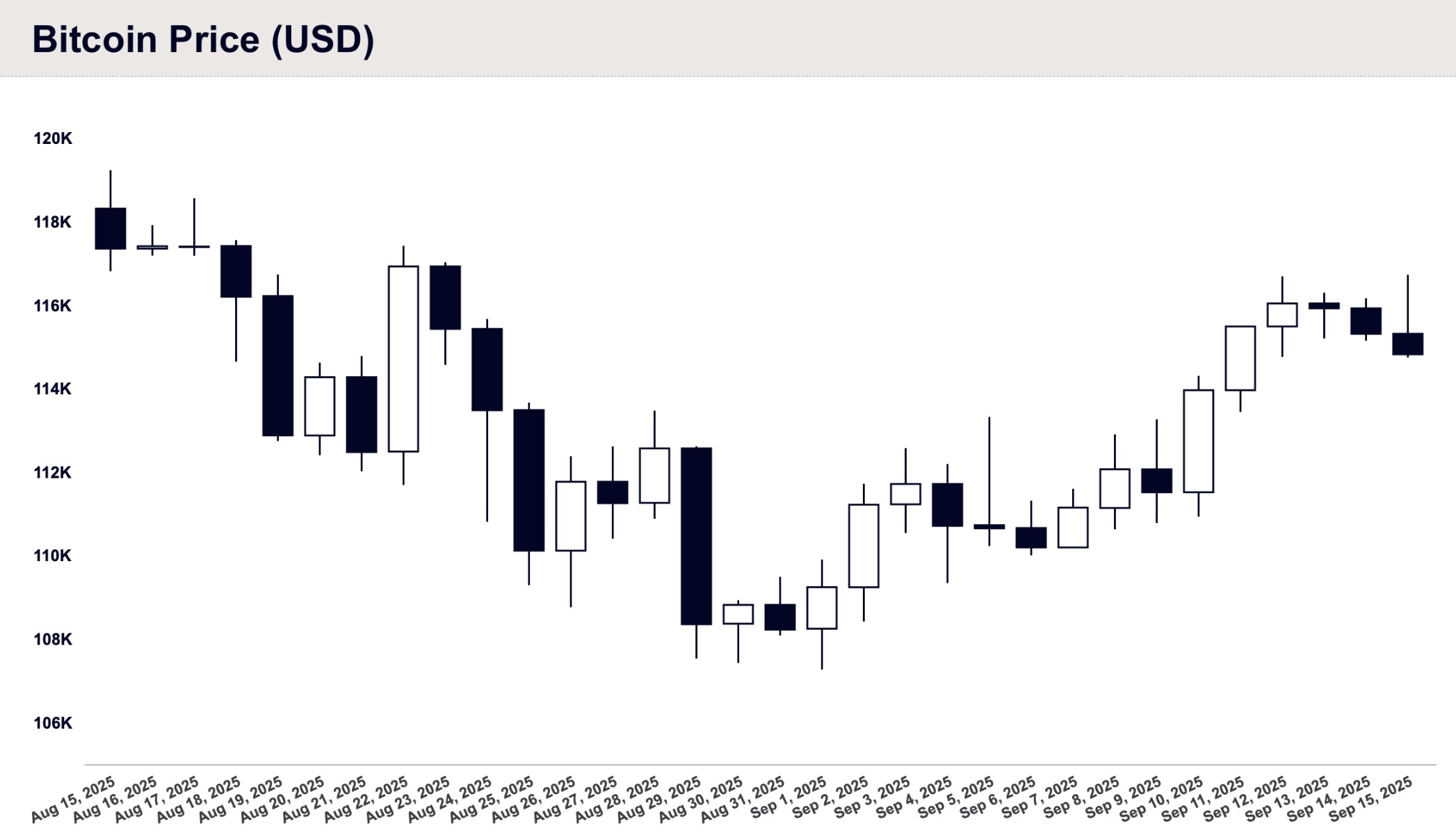

Bitcoin

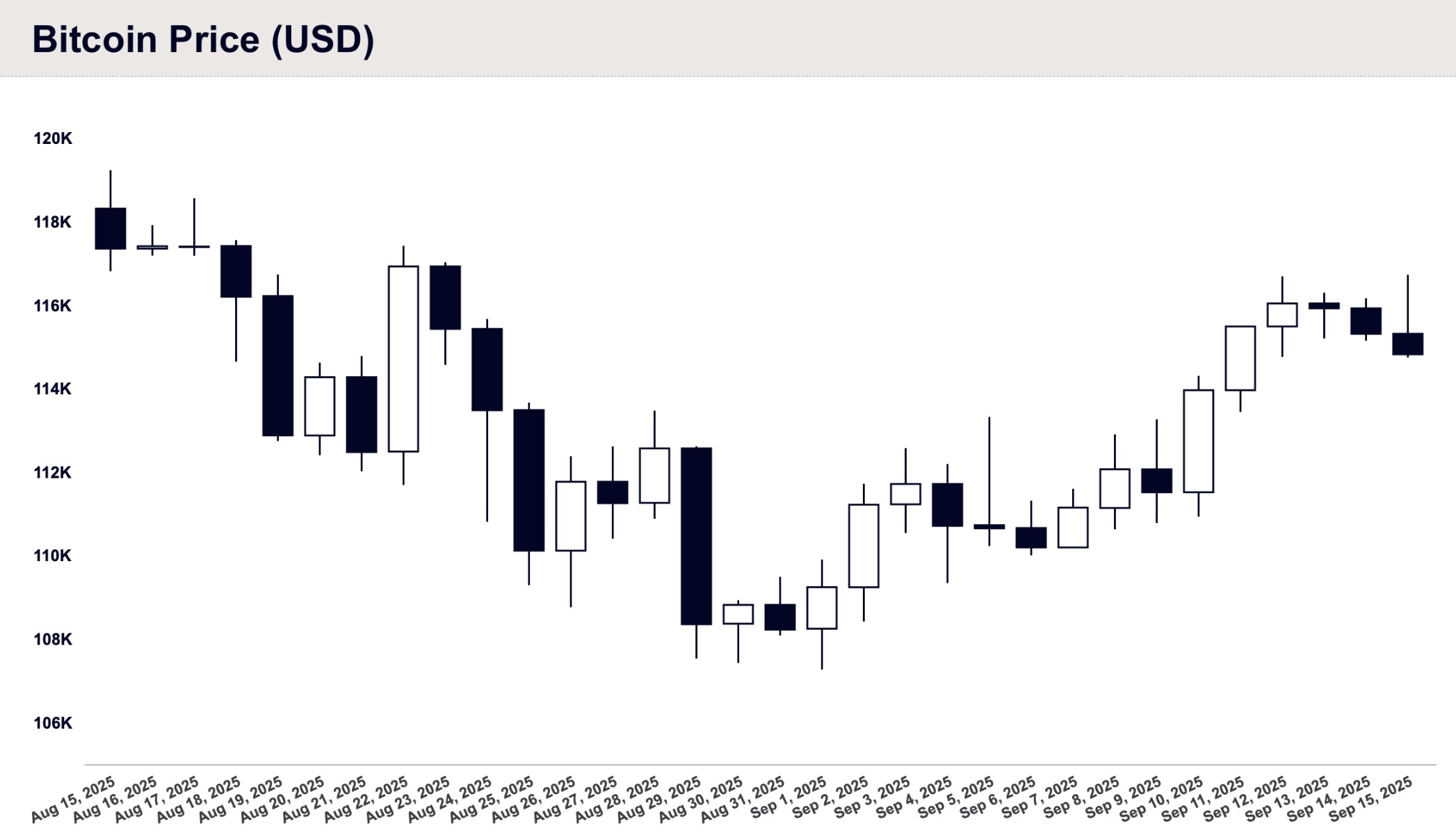

While Bitcoin has shown signs of recovery from its early September lows, its momentum has been capped by broader market uncertainty, including concerns over corporate treasury strategies after top holder Strategy (formerly MicroStrategy) was denied inclusion in the S&P 500. This has caused it to lag behind traditional risk assets, but its trajectory should now be impacted by the upcoming U.S. Federal Reserve decision on interest rates. Although a 25 basis point cut is widely anticipated, a more aggressive 50 bps move could act as a powerful catalyst, potentially sparking a significant rally.

Ethereum

Defying a historically bearish month, Ethereum has demonstrated significant strength, climbing 4% in September and surging nearly 8% over the past week to reach $4,650. With this momentum, the key factor for ETH is not just the expected rate cut, but the Federal Reserve's forward guidance. A more "dovish" tone that lays the groundwork for sustained monetary easing would be the true catalyst, likely accelerating capital flow into decentralized assets and paving the way for Ethereum to challenge its all-time highs.

Looking ahead

All eyes in the digital asset market are on this week's Federal Reserve meeting, and while a 25-basis-point rate cut is widely anticipated, the market's reaction will hinge on the details, as much of this optimism may already be priced in. A dovish signal that this is the start of a sustained easing cycle would significantly boost risk appetite, likely driving capital flows beyond Bitcoin into higher-beta altcoins from sectors like DeFi and GameFi. A surprise 50-basis-point cut would act as an even more explosive catalyst. Conversely, the market could face a "sell the news" event if the Fed delivers a "hawkish" cut, suggesting it is a one-off adjustment, which could trigger a short-term retraction. The worst-case scenario, a decision to hold rates steady, would defy all expectations and likely spark a significant correction. Ultimately, the key determinant for market sentiment will not be the cut itself, but the forward-looking language used in the Fed's press conference.

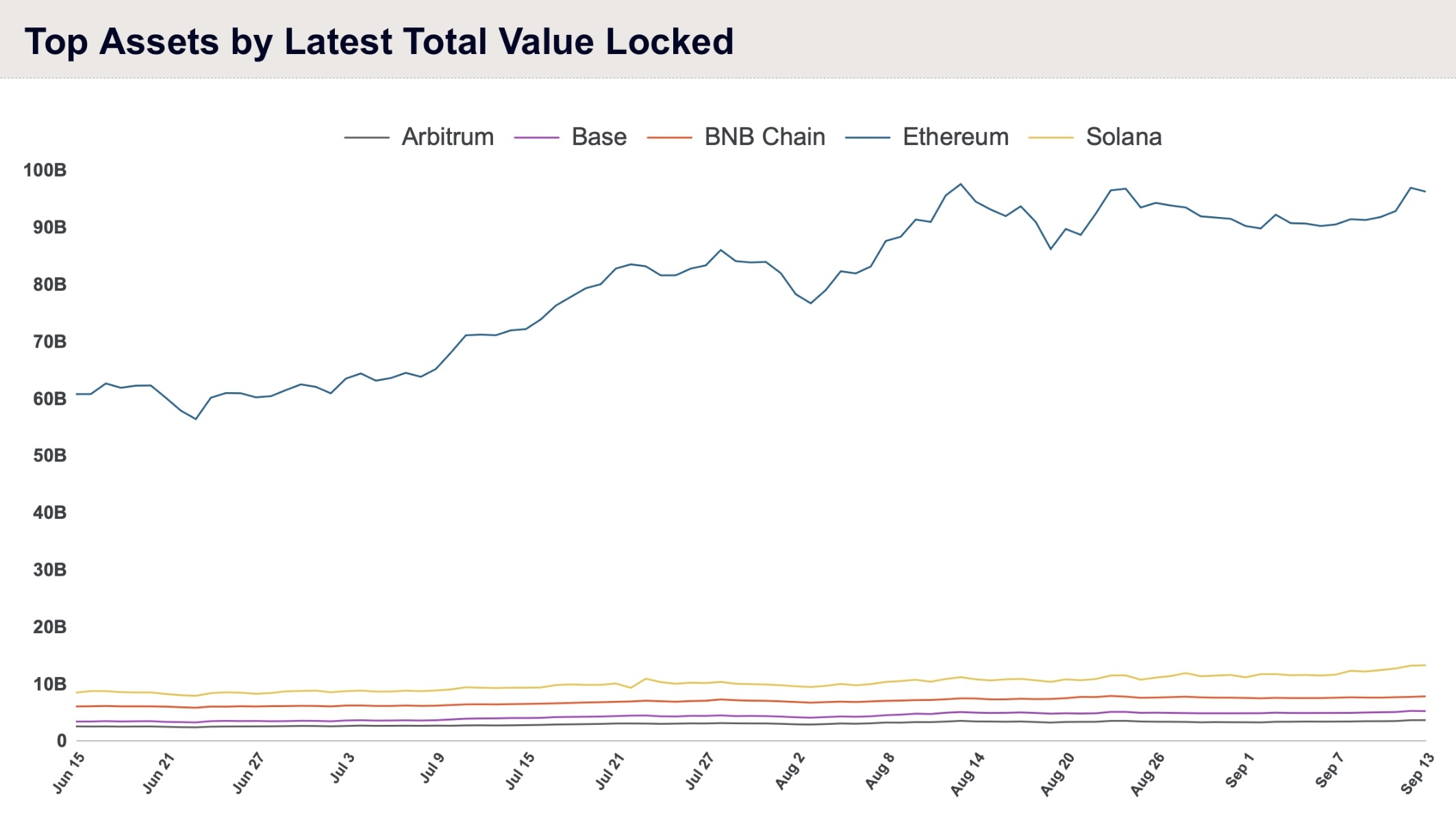

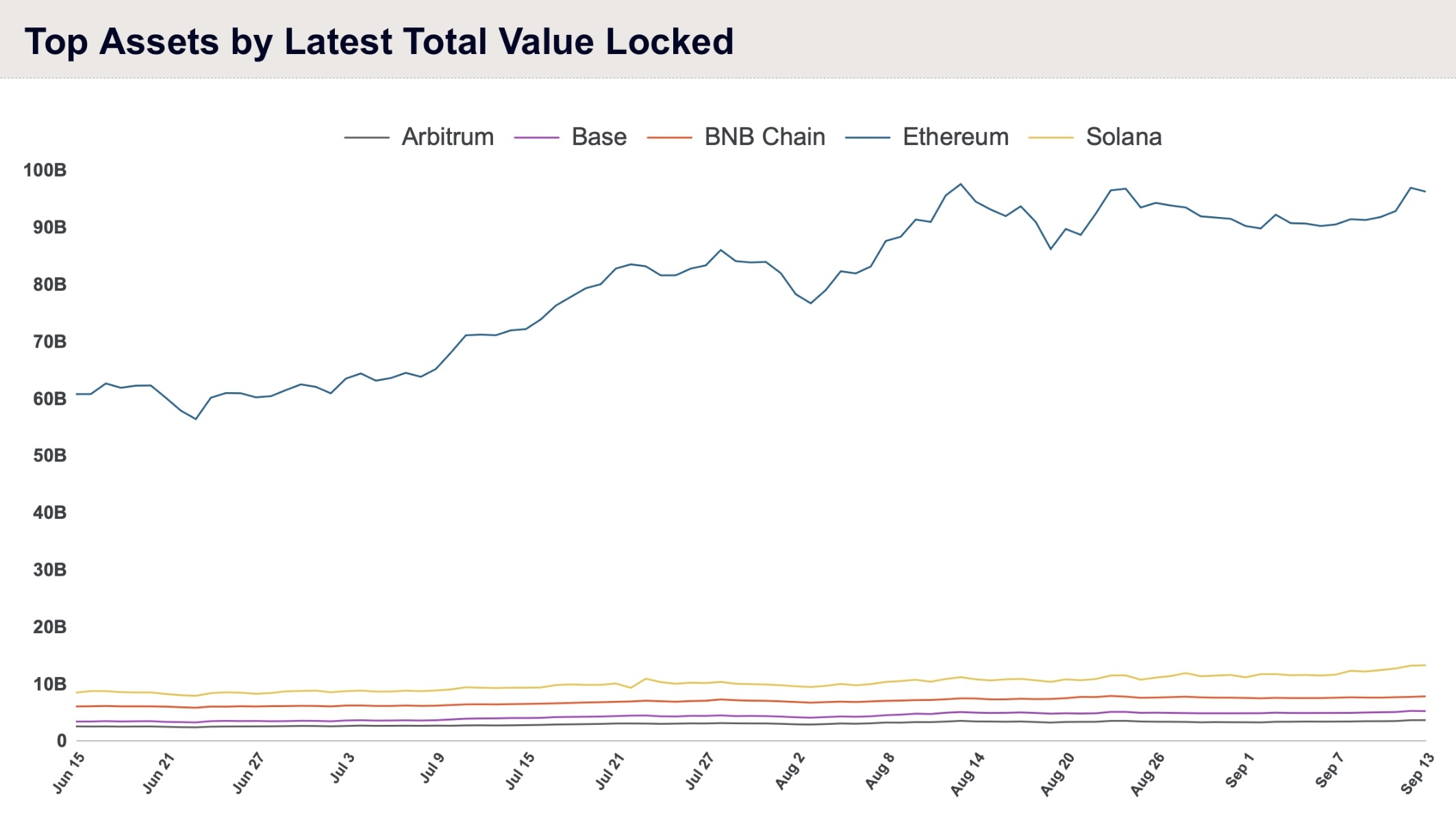

Chart of the Week

The chart "Top Assets by Latest Total Value Locked" refers to a key metric used to measure the health and adoption of a blockchain's decentralized finance (DeFi) ecosystem. Total Value Locked (TVL) represents the total dollar value of all cryptocurrency assets that users have deposited, or "locked," into that blockchain's applications for activities like lending, staking, or providing liquidity. A higher TVL indicates greater user trust and more economic activity. This chart, therefore, tracks the historical TVL from June to September for the blockchains that currently rank highest by this metric, visually demonstrating the scale of their DeFi ecosystems and highlighting Ethereum's vast lead over competitors like Solana and BNB Chain.