Spotlight: Powell's Press Conference in Focus

The crypto market is showing renewed strength heading into a pivotal week for macro policy. Bitcoin and major altcoins have posted positive returns over the past week, sparking cautious optimism as traders await cues from the Federal Reserve.

This recovery sets the stage for Wednesday's Fed decision. With no new economic forecasts scheduled, all market attention will shift to Chair Jerome Powell's press conference.

Powell is expected to echo his September message, reiterating that risks to the job market are growing while dismissing tariff-related inflation as transitory. This anticipated dovish stance is bolstering hopes for further easing, which could provide continued support for risk assets.

The Fed chief will undoubtedly face questions regarding the ongoing U.S. government shutdown. However, he is likely to downplay its economic impact and adhere to the Fed's existing September projections, which forecast inflation cooling to 2.6% in 2026.

Bitcoin: Whales Absorb Redistribution Flow

On-chain data indicates a significant redistribution is underway, even as Bitcoin posts a strong +6.96% return over the past week. For the first time this cycle, "illiquid supply" (coins held by long-term holders) is declining, signaling that some long-held coins are being sold.

However, Glassnode data shows that whales are quietly absorbing this flow. Wallets with large balances have been adding to their positions since mid-October, while smaller holders (holding 0.1 to 10 BTC) have been consistent sellers. This dynamic suggests weaker hands are trimming risk, while larger entities accumulate.

This dynamic of steady whale absorption helps explain Bitcoin's calm recovery from $110K toward $114.9K. The move appears to be a modest recovery powered by spot demand and mild short covering, rather than the start of a broad new uptrend.

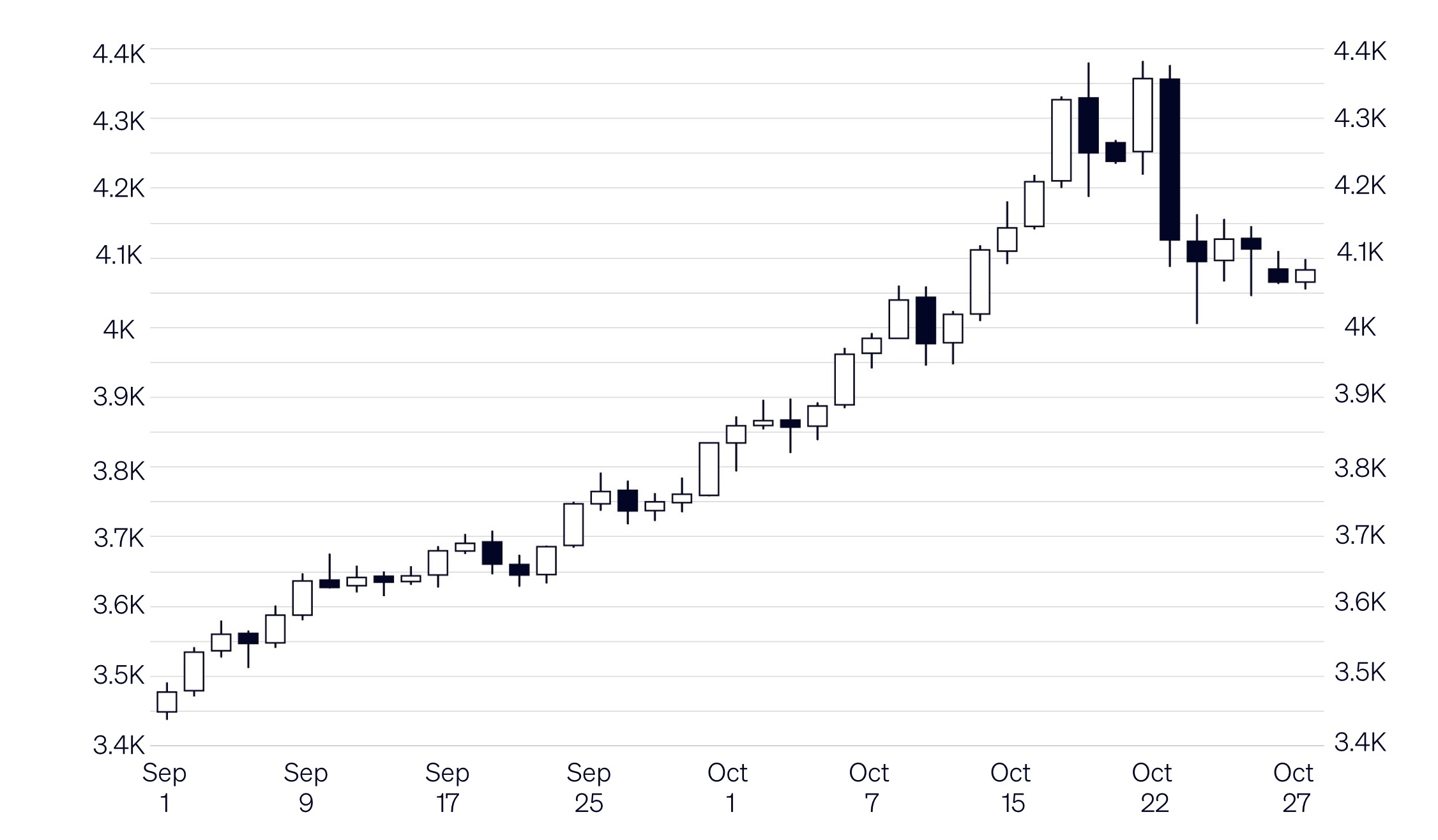

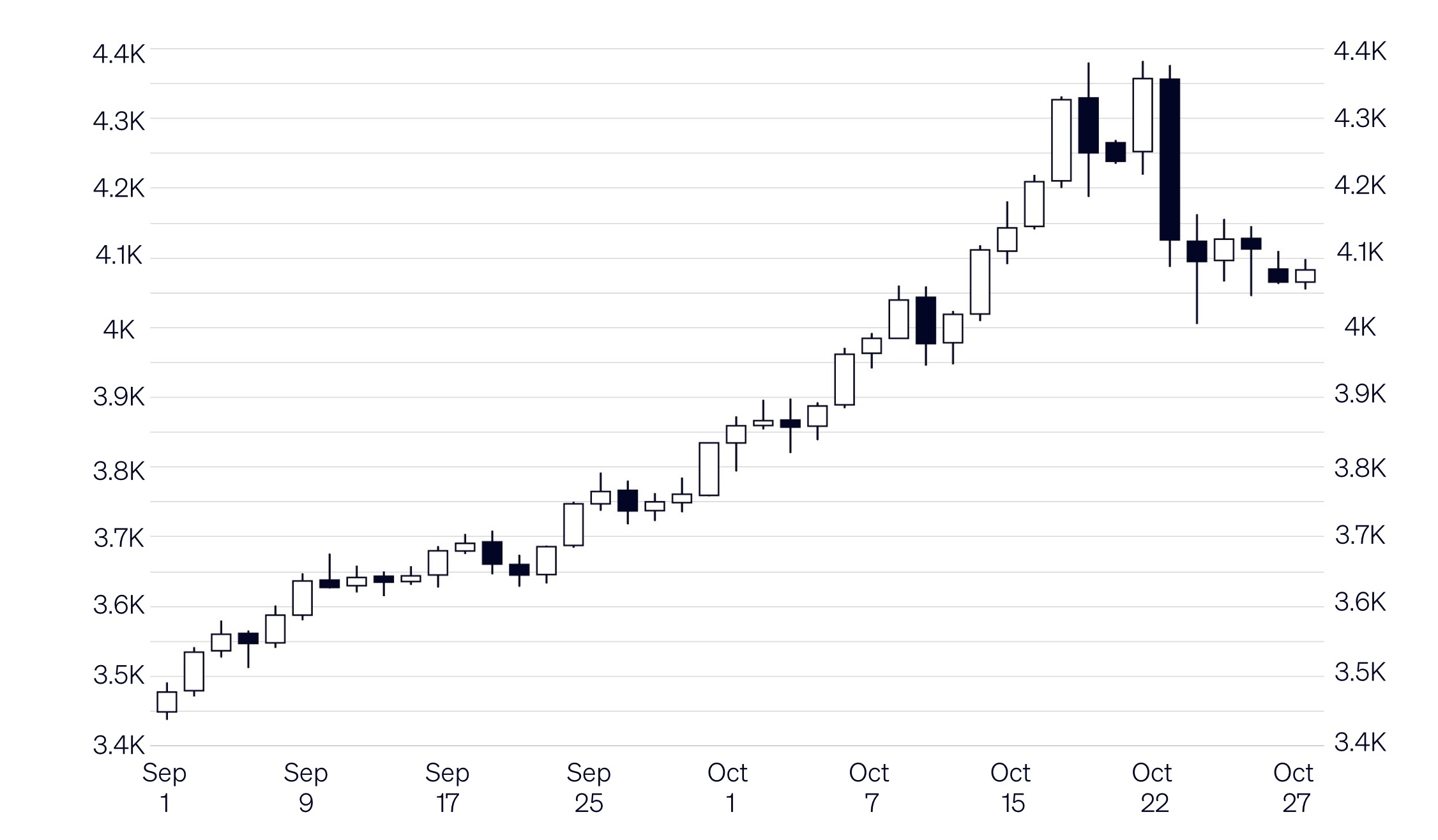

As Bitcoin stabilized, Ether climbed 6% to $4,225, outperforming the market leader as traders rotated into higher-beta assets. Elsewhere in hard assets, gold has seen a slight pullback in recent days as some investors take profits and rotate into risk-on assets, despite its impressive 53% appreciation since the beginning of the year.

Looking Ahead: Big Tech Earnings and Trump-Xi Summit

Traders are bracing for two major macro events this week that could inject volatility into the market.

First, key "Mag 7" members—including Apple, Meta Platforms, Alphabet, and Microsoft—are set to announce earnings. These reports will be closely scrutinized for any slowdown in AI-related tech spending, which has been a primary driver of the market rally since 2023.

Second, U.S.-China trade tensions eased over the weekend after both sides announced a trade deal was "nearing." This positive rhetoric comes just days before President Donald Trump and his Chinese counterpart Xi Jinping are scheduled to meet in person on Thursday at the APEC Summit in South Korea. The high expectations mean any disappointment from the talks could trigger a significant "risk-off" reaction.